Explore our IP Address Database Downloads for instant access to our IP address insights

Learn morePreventing transactions fraud by using IP data

2020 has so far been a good year for online businesses. The recent lockdowns have supercharged an already growing trend: online buying.

It is estimated that in 2020 alone we will have spent over $4 trillion dollars online. This figure is projected to double by 2024, reaching a whopping USD 8 trillion.

While such accelerated growth means more opportunities for online retail, it also poses a higher risk of online scams and ultimately more losses.

Growing risks of online scams

In the US alone, more than 3 out of 4 merchants have been victims of fraud, while over 42% of consumers have experienced at least one fraudulent attempt to use their credit cards. What this means is that almost 1 out of 3 online transactions has been fraudulent.

Overall the cost of cybercrime is massive. While in 2018 alone worldwide fraud losses were evaluated around USD 27.85 billion, up 16% from the year prior, 2019 estimates place the damage at 42 billion according to a PwC survey.

Decreased consumer confidence caused by fraud

However, the negative impact does not stop here. Consumer confidence has also been severely affected by the rise in online scams, dropping from 63% in 2018 to 57% the following year due to fear of fraud.

As for 2020, the situation shows no signs of improvement. While the numbers are not in yet, with billions of people being forced to stay at home, things are bound to get worse.

“Now that many transactions have shifted online, fraudsters have tried to take advantage and companies must adapt. Businesses that come out on top will be those leveraging fraud prevention tools that provide great detection rates and friction-right experiences for consumers,” said Shai Cohen, Senior VP of Global Fraud & Identity Solutions at TransUnion, in an interview for GLOBE NEWSWIRE.

Preventing fraudulent transactions by using IP data

While the impact of online scams is massive, there is good news for those affected! Merchants, banks, and payment companies can now access increasingly affordable tools and solutions to protect both their bottom line and their customers.

Protecting E-commerce against E-scams

The first priority in any anti-fraud strategy is to protect the critical areas in the shopping experience: sign-up, login, purchase, and funds deposit or withdrawal.

As an e-commerce merchant, knowing users’ location is an important step in preventing online scams. By using IP Intelligence and geolocation technology, merchants can automatically block malicious traffic, request extra authentication steps (via email or SMS), or flag suspicious activity for further internal review. In the end, building smarter rules around fraud detection and automating the geolocation process is proven to increase detection rates, reduce false positives, and improve the overall shopping experience.

Fighting online scams, however, does not stop here. Anti-fraud strategies often involve all of the companies that are part of the online shopping ecosystem.

For example, IP data is often used by online payment and money transfer companies, not just by merchants themselves.

Anti-Fraud for Payment Processors

Paypal, the industry-leading payments processor, uses IP geolocation to track and verify shipping addresses as well as keep customer records, including their IP address, in order to prevent fraud.

Stripe, another prominent online payment processing company, looks at the IP address as one of the key indicators of whether the payment is legitimate or not. For example, some of the more common fraud indicators include making multiple rapid-fire payments (including declined ones) using the same credit card and from the same IP address.

At IPinfo, many of our clients, both merchants and payment processors, use IP data to prevent phishing, ID fraud, and botnets from abusing their services. By using IP geolocation and classification, they can gain more insights about the person (or bot) that is attempting a transaction, which is highly valuable data that feeds into the fraud scoring process.

IPinfo Geolocation API provides information on the IP’s country, city, ZIP code, latitude, longitude, and other geographical data in the real world that can be used to resolve web traffic to a specific location.

How does IP geolocation based fraud scoring work?

IP data is an important part of any fraud detection workflow. Payment gateways can employ it in a number of ways to prevent fraud, either alone or in conjunction with other types of data.

By cross-referencing IP Geolocation with Card Issuer data, payment companies can identify and flag discrepancies. Take Ms. Jane Doe with her New York-issued card and a billing address in Easton, Pennsylvania; when her card attempts a transaction from a Shanghai-based IP, this may put up a flag. Does this automatically mean this is fraud? Not necessarily, but this should increase the fraud score and, perhaps, result in a human review before fully charging the card. If Jane Doe confirms she has been traveling, the transaction is marked as safe. If, however, several consecutive transactions are made from different IPs and locations all around the world, the transactions get blocked.

Lockout Mechanism also prevents scammers from using automatic card number generators. The scammer may attempt hundreds of these randomly generated numbers until they find one that works and then charge the account to the limit. In order to prevent this, payment processors can look for specific IPs with a large amount of declined cards within a defined period of time (for instance 24h) and lockout transactions from it.

Transactions from high-risk countries are another indicator of a potential credit card con that is worth looking into. The European Commission, for instance, identifies Afghanistan, Bosnia & Herzegovina, Guyana, Lao PDR, Uganda, Vanuatu, Yemen, Ethiopia, Sri Lanka, Trinidad & Tobago, Tunisia, Pakistan, Iran, and North Korea as high-risk countries. If the payment or order was made from an IP originating from one of these countries, it can be stopped.

IPinfo Geolocation API provides information on the IP’s country, city, ZIP code, latitude, longitude and other geographical data in the real world that can be used to resolve web traffic to a specific location.

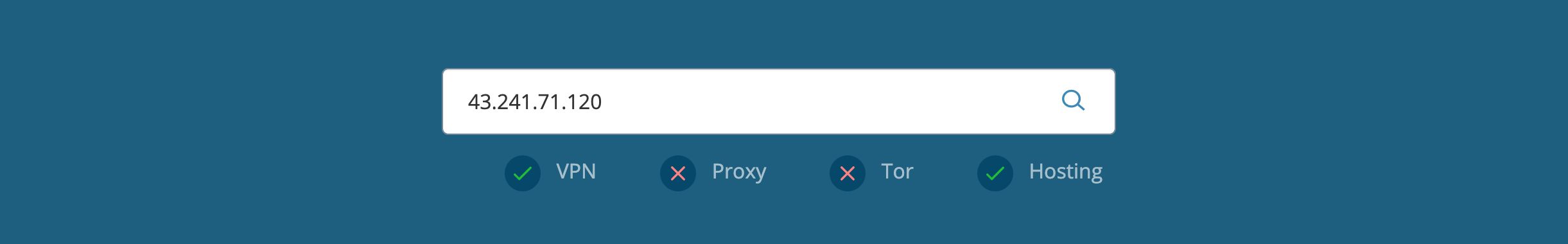

Detecting VPN, Proxy and Tor traffic

Other times, however, online scammers can employ more elaborate tactics. Often, the fraudster will hide their real IP address behind a VPN, Proxy, or Tor in order to bypass fraud-detection workflows and fake their location.

For example, if a card is issued in Berlin and the fraudster is located in Manila, an IP geolocation tool should easily spot their true location. However, if the fraudster is using a VPN, proxy or Tor, they’ll be able to mask their real IP address and geolocation, and appear as if their transactions are occurring in Berlin. In this case, using IPInfo’s Privacy Detection API helps spot obscured traffic and identifies anyone trying to mask their real IP address and tunnel traffic.

Of course, IP data alone is not enough to stop online scams. It’s important to correlate geolocation information (where) with other data sources such as cookies and browser session (who). Used together these data points paint a complete picture of the user’s activity and have a better chance of detecting fraud.

Try Us Out

The fight against online scams is a never-ending battle, with fraudsters constantly and ingeniously coming up with new ways to trick fraud prevention workflows. Given the ever-growing number of online transactions, the stakes have never been higher.

That is why having fast, reliable, and accurate data sources is a must. In the end, when fighting fraud, false negatives translate to losing money, while false positives generate frustrated clients and eventually higher churn.

IPinfo is the trusted data source for over 100,000 businesses and developers, including some of the internet’s most recognized e-commerce and payment companies. Our geolocation, ASN, IP ranges, and privacy detection provide super-accurate data for cross-referencing financial transactions and automating fraud detection workflows. Our APIs are fast and stable making IPinfo a trusted partner in the fight against online scams. Give it a try!

About the author

Internet Data Expert